What's a policy excess?

- An excess is an insurance term for the sum of money you'll need to pay if you have to make a claim.

- You must pay your excess before we can deal with/settle your claim.

- Your total policy excess is comprised of your compulsory excess, voluntary excess and any other excesses that may apply to your policy.

To see how much excess you'll have to pay in the event of a claim just take a look at your Policy Schedule.

Compulsory excess

- This is a sum of money that you must pay in the event of a claim.

- You can find out how much you would have to pay on your Policy Schedule.

Voluntary excess

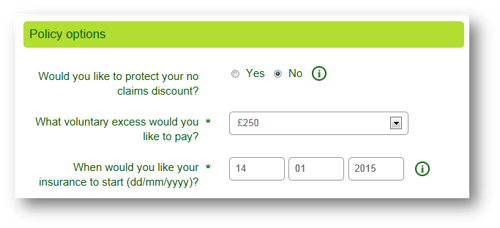

- You choose your voluntary excess when you buy your policy with us.

- This means if you have to make a claim, you'll need to pay your compulsory excess plus the voluntary excess amount chosen by you when you bought the policy. (Please note that additional excesses may apply - please see below).

So, why would you pick a higher excess? Usually, the higher voluntary excess you choose, the cheaper your premium will be. Remember though, if you choose a higher excess, you'll have to pay this in the event of a claim.

For example, if you choose to pay a voluntary excess of £250 in the event of a claim, your premium may be less than if you choose to pay £150.

Young driver excess

- If you're aged 21-24 years old, you're required to pay an additional £200 on top of any other excesses that apply to your policy.

Non-approved repairer excess

- If you choose to have your car repaired by a non-approved repairer, you’ll have to pay an additional excess - £500 for Essentials customers, £250 for Plus, Plus with Roadside, Plus with Legal and Premier customers.

Windscreen excesses

With Plus, Plus with Roadside, Plus with Legal and Premier, if you have a damaged glass, we’ll repair or replace it:

- Windscreen replacement will cost you £150 in excess charges if you use our approved supplier.

- Windscreen repairs to chips or scratches will cost you £25 in excess charges if you use our approved supplier.

To use a non-approved supplier we will cover you up to a maximum of £50 for repair/replacement. Any costs above this will have to be paid for by you, e.g., if the cost of repair is £60, you'll have to pay £10.

Essentials does not include any cover for glass only claims – this means there is no cover should you have any damage to your car that only affects your windscreen, windows or sunroof glass. However, if your glass is damaged in an accident, we’ll replace it as part of your overall car repair.

For more information on this, please see the Glass Repair section on page 3 of your Policy Schedule.